January 14th, 2026

How to Build a Resilient Emergency Fund in a Changing Economy

How to Build a Resilient Emergency Fund in a Changing Economy

In January, the new year presents a perfect moment to reset—and build financial resilience. As 2026 unfolds, it brings opportunity: forecasts point to moderate economic growth, inflation easing, and potential interest-rate cuts. Harness this fresh start to strengthen your financial safety net.

📌 Economic Snapshot: Why 2026 Is Pivotal for Savings

- Steady Growth & Cooling Inflation

U.S. real GDP is expected to grow between 1.8–2.3%, supported by favorable fiscal policies and AI-driven productivity—while inflation eases to around 2.6–3%. - Interest-Rate Relief on the Horizon

The Federal Reserve signaled possible rate cuts in January and spring, aiming to balance inflation and moderate labor markets. - January Momentum

Financial advisors call January "the natural reset." Clear goal-setting, budget reviews, and automated savings launched now compound all year.

Step 1: Set a Strong Starting Point

Just getting started?

- Begin with a modest but achievable goal like $500.

- Automate contributions into MTC Federal’s Basic Savings Account—even $10/week can lay the groundwork for habit and habit for growth.

Step 2: Scale with Smart Tiered Goals

Once you reach your starter goal:

- Open dedicated Custom Savings Accounts for plans like medical, auto, or home repair.

- Named goals help track progress and reduce the temptation to dip into your core emergency fund in a pinch.

Step 3: Optimize for Growth as You Save More

If you’ve already built a substantial buffer:

- Move funds into High Yield Savings , Money Market Accounts or Share Certificates for better returns—while staying accessible.

- With inflation trending down and rates likely to fall, locking in higher yield now could pay off.

Step 4: Make It a Sustainable Habit

- Automate transfers now and schedule regular check‑ins.

- In January, align your savings habits with other 2026 goals like debt reduction, investing, or homebuying.

- Set a reminder to review every six months—and adjust for changes in income, expenses, or economic trends.

Why Now Is Your Moment

- Fresh start: January offers clarity—and motivation—for building positive money habits.

- Economic tailwinds: From anticipated rate cuts to inflation easing, the conditions today can help your savings stretch further.

- Planning power: With clear goals and automated tools, you can lock in progress for the rest of the year.

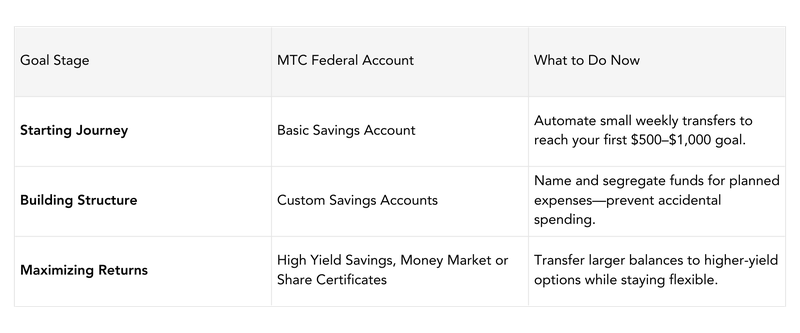

Your 2026 Savings Action Plan with MTC Federal

*terms and conditions apply. Please visit our Savings Account page for all details, rates & terms on savings accounts.

Ready to Build Resilience This Year?

Jumpstart your emergency fund today with the savings solution that fits where you are now:

- Basic Savings to begin building.

- Custom Accounts for priority goals.

- High Yield Accounts to grow a solid cushion.

MTC Federal Credit Union supports every step—whether you're starting from scratch or optimizing significant savings. Start strong this January and set your financial footing for a successful 2026.