Positively Credit Worthy

Tips to gain the power you need to handle credit responsibly.

Use Credit Wisely

The word “Credit” comes from the Latin word for “Trust.” This means that someone trusts someone else to repay the money loaned.

With more and more choices for credit, more rebate offers, coupons, and hotel reservations; the average person has tough decisions to make regarding the wise use of credit.

GOOD DEBT, BAD DEBT

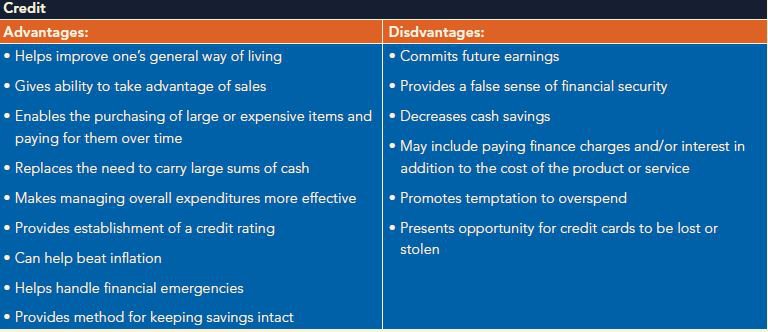

Credit itself is neither a positive nor a negative thing; it can either be used wisely or recklessly. Unwise use of credit can lead to serious financial problems. Therefore, consider the advantages and disadvantages of credit transactions. Credit adds flexibility to your financial planning and allows you to have the things you need and want by buying now and paying later. When treated as a privilege, credit can help you have and enjoy more. However, you need to control credit or it can control you!

REVIEW YOUR CREDIT REPORT

If you have ever applied for a credit card, a personal loan or insurance, there’s a file about you. This file contains information on where you work and live, how you pay your bills, and whether you’ve been sued, or filed for bankruptcy. Companies that gather and sell this information are called Consumer Reporting Agencies (CRAs). The most common type of CRA is the credit bureau—the three main CRAs are Experian, Equifax and TransUnion. The information CRAs sell about you to creditors, employers, insurers and other businesses is called a consumer report.

THE FAIR AND ACCURATE CREDIT TRANSACTIONS ACT OF 2003 (FACT ACT)

The Fair and Accurate Credit Transactions Act of 2003 is a United States federal law, passed by the United States Congress on November 22, 2003, as an amendment to the Fair Credit Reporting Act. The act allows consumers to request and obtain a free credit report once every twelve months from each of the three nationwide consumer credit reporting companies (Equifax, Experian and TransUnion). In cooperation with the Federal Trade Commission, the three major credit reporting agencies set up the website, www.annualcreditreport.com, to provide free access to annual credit reports. If there is incorrect information on a credit report, you have the right to file a dispute. After an investigation by the credit bureau, they will remove it from your credit report if it is proved to be incorrect.

EXPERIAN

1-888-397-3742 | PO Box 2002 | Allen, TX 75013

EQUIFAX

1-800-685-1111 | PO Box 740241 | Atlanta, GA 30374-0241

TRANSUNION

1-800-916-8800 | PO Box 1000 | Chester, PA 19022

HANDLING DEBT PROBLEMS

Many people face a financial crisis at some point in their lives. Whether the crisis is caused by personal or family illness, the loss of a job, or simple overspending, it can seem overwhelming, but often can be overcome. The fact of the matter is that your financial situation doesn’t have to go from bad to worse. If you or someone you know is having financial difficulty, consider these options: realistic budgeting, credit counseling or debt consolidation. How do you know which will work best for you? It depends on your level of debt, your level of discipline, and your prospects for the future.

REALISTIC BUDGETING

The first step toward taking control of your financial situation is to do a realistic assessment of how much money comes in and how much money you spend. Writing down all your expenses — even those that seem insignificant — is a helpful way to track your spending patterns, identify the expenses that are necessary and prioritize the rest. The goal is to make sure you can make ends meet on the basics: housing, food, transportation, health care, insurance and education.

CREDIT COUNSELING

If you aren’t disciplined enough to create a workable budget and stick to it, can’t work out a repayment plan with your creditors, or can’t keep track of mounting bills, consider contacting a credit counseling service. Your creditors may be willing to accept reduced payments if you enter into a debt repayment plan with a reputable organization. In these plans, you deposit money each month with the credit counseling service. Your deposits are used to pay your creditors according to a payment schedule developed by your counselor. As part of the repayment plan, you may have to agree not to apply for – or use – any additional credit while you’re participating in the program.

DEBT CONSOLIDATION

You may be able to lower your cost of credit by consolidating your debt through a second mortgage or a home equity line of credit. Think carefully before considering this option. These loans typically require your home as collateral. If you can’t make the payments — or if the payments are late – you could lose your home.

The costs of these consolidation loans can add up. In addition to interest on the loan, you pay “points.” Typically, one point is equal to one percent of the amount you borrow. Still, these loans may provide certain tax advantages that are not available with other kinds of credit.

Contacting Your Creditors: Remember to contact your creditors immediately if you are having trouble making ends meet. Tell them why it’s difficult for you, and try to work out a modified payment plan that reduces your payments to a more manageable level. Don’t wait until your accounts have been turned over to a debt collector.

Source: GreenPath Financial Wellness.